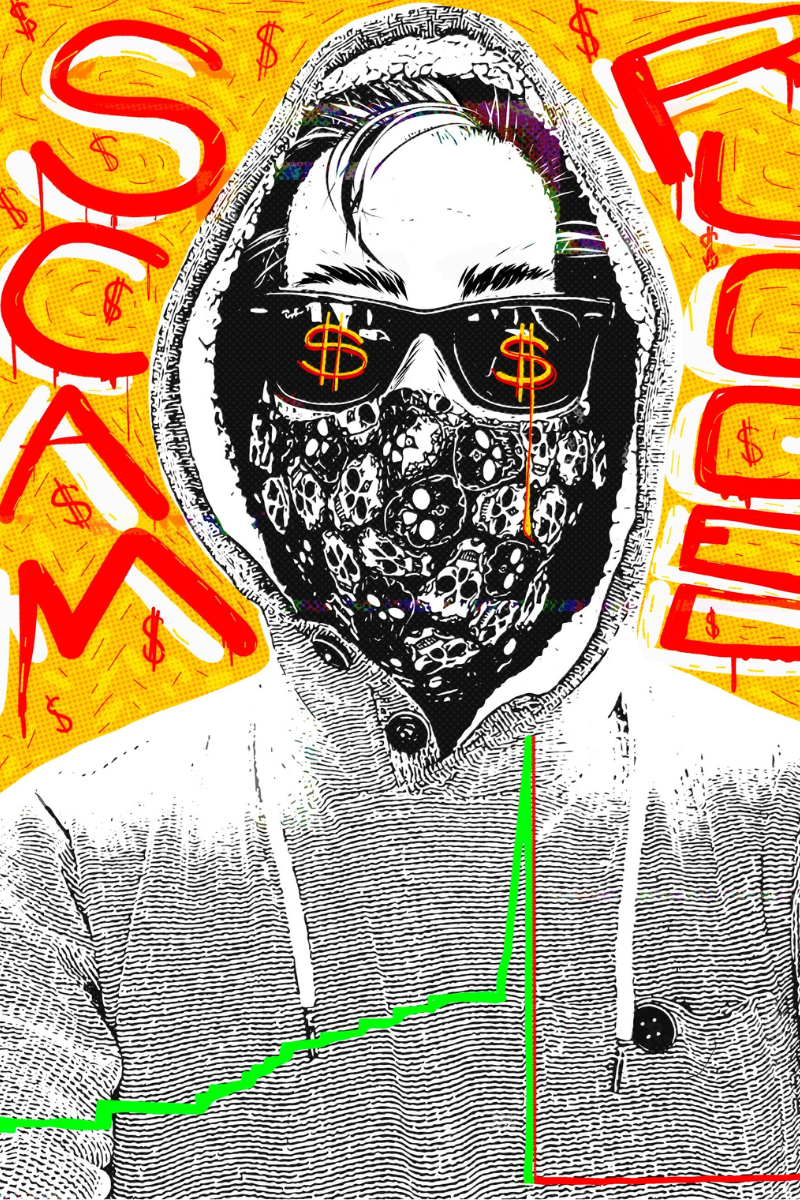

WASHINGTON, DC – Just a few months ago, 30-year-old Sam Bankman-Fried – SBF as he is widely known – was Washington’s darling link to the crypto arena. The “Future Currency” (FTX) founder spent swaths of time in and around Capitol Hill, donating large sums to the Democratic Party, championing his digital currency exchange and crypto hedge fund and commitment to effective altruism with significant philanthropic donations. At its pinnacle in January 2022, FTX’s market value exceeded $32 billion, having grown exponentially from its starting point in 2019.

As of this writing, SBF is housebound at his parents’ Palo Alto residence, donning an ankle monitor. After his extradition to the United States from the FTX base in the Bahamas, SBF faces 115 years behind bars if convicted of all eight charges filed by the U.S. Department of Justice late last year. These range from money laundering and wire fraud to commodities fraud and violation of campaign finance laws.

So what went wrong, and what impact has the FTX collapse and criminal allegations had on the broader crypto world?

In essence, FTX operated like the New York Stock Exchange. But rather than allowing clients to buy and sell stocks of major organizations, the outlet enabled people to purchase and sell cryptocurrencies, meaning they are the custodian in holding and safeguarding your funds.

The first hint of trouble in paradise emerged in August last year when a U.S. bank regulator mandated FTX to stop “false and misleading” assertions about whether the government insures company funds. Then, in early November, crypto news site CoinDesk exposed details of a leaked balance sheet showing that the crypto trading platform, Alameda Research, was financially reliant on FTT, FTX’s original token. As a result, major cryptocurrency exchange Binance announced the firm would liquidate its FTT holdings, and the value of FTT rapidly descended as clients hurried to withdraw their funds.

However, the $8 billion needed to fulfill the sudden withdrawal requests was not there. Allegations indicate that FTX improperly used customer funds to bolster Alameda Research, a firm SBF helped get off the ground in 2017. It was run by a reported romantic interest and housemate, Caroline Ellison. Further, the Securities and Exchange Commission accuses Bankman-Fried of illegally using investors’ money to buy real estate for himself and his family.

A clambering SBF sought VC investors, and initially, Binance entered the negotiations fray to purchase FTX’s non-U.S. businesses. Nevertheless, Binance rapidly backed out, with CEO Changpeng Zhao pointing to the mass of “mishandled customer funds and alleged U.S. agency investigations” which were “beyond (Binance’s) control or ability to help.”

Two days later, SBF stepped down, and FTX filed for Chapter 11 bankruptcy.

And while the FTX fallout capped off a grim year for the crypto industry and a furor of breathless mainstream media headlines, just like the legacy finance industry, one bad apple does not mean the whole sphere is rife with criminals.

As a silver lining, the collapse is likely to bring about a broad sweeping out of any other nefarious actors, but there are important takeaways and lessons to be learned.

At face value, FTX lacked the transparency that comes with the decentralization motif of crypto’s underlying technology, Blockchain, and operated more like a centralized bank without oversight or regulation. Subsequently, there was no way to know that the company fraudulently used consumer funds for Alameda and its private investment projects.

And despite the billions VC firms poured into FTX, none of those investors sat on FTX’s board. While leading an isolated island life, SBF developed a reputation of hanging around only a small, select cadre of fellow crypto connoisseurs and colleagues, including Caroline, nestled inside the penthouse of a 600-acre oceanside resort he called home.

Another key takeaway? Amateur and retail investors routinely seek rapid returns and often need to learn more to differentiate between centralized and decentralized businesses. Therefore, before investing, every individual should do their due diligence to understand the various platforms and who and what is behind prospective coins and tokens.

Nevertheless, FTX has put crypto on the map so that regulation may come sooner than expected, with crypto now a hot topic in the House Financial Services Committee and Senate Banking Committee.

However, lawmakers must understand that decrees for centralized and decentralized enterprises should be different. A mammoth crackdown on decentralized finance (DeFi) would hamper innovation, the core tenant of the still new and cutting-edge industry. Of course, one can blame crypto’s misgivings on humans, but the incrimination should not extend to the revolutionary technology.

In recent weeks, reports have also surfaced that the U.S. Federal Trade Commission has opened an investigation into several crypto companies for “possible misconduct concerning digital assets.” So again, this may not be a complete negative – and a good time to clean up any other rotten firms or players.

Meanwhile, FTX might not be totally dead. John J. Ray III – a seasoned expert in restructuring plagued companies, most notably returning billions to creditors following energy company Enron’s downfall in the early 2000s – took over as chief executive in November. Ray’s primary task is to return money to customers and creditors.

In an interview with the Wall Street Journal in January, he said he had established a task force to scrutinize restarting the failed exchange, obviously with many more scruples in place. Nevertheless, despite the alleged criminal misconduct of its top echelons, some analysts and consumers have lauded the technology and value of a restart.

According to the Journal, Ray has “radically overhauled FTX’s structure, which had effectively no corporate governance to speak of and cut dozens of employees.” In addition, his forensic units continue to wade through over 30 terabytes of FTX’s data to draw out any information that could lead them to more hidden funds. Ray’s task force has secured over $740 million in crypto belonging to the FTX platform, but that is only a fraction of what is missing.

And Ray hasn’t minced words on the topic of FTX’s misdeeds under the SBF leadership.

In a December hearing before the House Financial Services Committee, Ray testified that an “unprecedented lack of documentation drove the “paperless bankruptcy” and a shocking accumulation of poor financial controls and decisions over many months, even years.

“This is not something that happened overnight or in a context of a week,” he stated in prepared remarks. “FTX Group’s collapse appears to stem from the absolute concentration of control in the hands of a very small group of grossly inexperienced and unsophisticated individuals who failed to implement virtually any of the systems or controls necessary for a company entrusted with other people’s money or assets.”

In subsequent interviews, Ray has referred to FTX’s actions as not necessarily unique to the crypto space but rather “old fashion embezzlement, taking money from others and using it for your own purposes” with “no sophistication at all.”

So from a legal perspective, where does the FTX case stand now?

FTX is also currently under criminal investigation in the Bahamas. Late last year, Caroline Ellison and FTX cofounder Gary Wang pleaded guilty to “charges arising from their participation in schemes to defraud FTX’s customers and investors, and related crimes” and are cooperating with the government in the FTX case.

Meanwhile, in early January, SBF pleaded not guilty to all criminal charges in a New York federal court. He is confined to Northern California and will face trial on October 2.

Yet despite the damage FTX has thrust upon the industry, the actions of the unscrupulous should not sow distrust of the technology. On the contrary, the scandal could propel the market more toward the decentralized side, putting weight behind fully transparent projects on the Blockchain.

Financial crimes are as old as time – pushing out the unethical this early in the crypto game can only be a plus.